- Introduction

- Blair and Brown’s banker

- Financial services for the poor

- Meet the impact gang!

- Saving capitalism

- Privatising government

- Problems and solutions

- The fascist model

- Freed from regulations

- Profits before people

Social impact investing is at the heart of the Great Reset. It reduces human beings to the status of potential investments, sources of profit for the wealthy elite.

In ‘Guerrillas of the Great Reset‘ we saw how the Guerrilla Foundation, ostensibly a body that gives grants to activists involved in “a variety of social causes”, in fact very much belongs to the world of social impact investment.

Founder Antonis Schwarz (pictured) even actively promotes a WEF-supported course on ‘Impact Investing for the Next Generation’ aimed specifically at young billionaires.

Founder Antonis Schwarz (pictured) even actively promotes a WEF-supported course on ‘Impact Investing for the Next Generation’ aimed specifically at young billionaires.

And our five-part series on the WEF’s Global Shapers revealed that impact investment is one of the pillars of their New Normal project.

There is a section of their website entitled ‘Impact’ and the term crops up time and time again, like an sinister leitmotif, throughout their activities in the UK, Europe, the USA, Africa and India.

If you want to understand what impact investment is all about, we recommend you explore the work of Alison McDowell of the Wrench in the Gears site – here and here, for example.

But why take the word of an outspoken opponent of impact investment? Why not go straight to one of the leading figures behind its development and find out what he has to say about it?

Sir Ronald Cohen, a 75-year-old UK businessman and political mover and shaker, is sometimes called “the father” of impact investment.

He is notorious in the UK for bankrolling the neoliberal “New Labour” governments of Tony Blair and Gordon Brown.

Reported The Evening Standard in 2006: “Sir Ronald is believed to have donated up to £800,000 to the Labour Party, and is clearly carving out a role to become the Chancellor’s ‘private banker’.

“Sir Ronald and his wife Sharon have rubbed shoulders with Prince Charles and are friends of Bill and Hillary Clinton, who they regularly entertain at their luxury second home in New York”.

Cohen is apparently a member of the executive committee of the International Institute of Strategic Studies, “a world-leading authority on global security, political risk and military conflict”.

IISS’s funders include NATO, the Organisation for Security and Cooperation in Europe, Rockefeller Brothers Fund, the UK Ministry of Defence, the UK Foreign and Commonwealth Office, the British Army, the Canadian Department of Defence, the Carnegie Corporation, BAE Systems, GKN Aerospace, the Embassy of Israel to the UK, the Kingdom of Bahrain, The Nicky Oppenheimer Foundation and US Friends of the IISS, which “allows the Institute to raise tax-deductible contributions in the United States”.

On its website it offers visitors “analysis with impact”.

Cohen has been involved in controversy in the past.

He was chairman of venture capital firm Apax Partners at the time of the Apax-owned British United Shoe Machinery pension collapse in 2000, which left 544 workers, many of them with long service, without any pension. (1)

MPs Edward Garnier, Patricia Hewitt and Ashok Kumar all called for a proper enquiry, Garnier citing the “mysterious circumstances” under which the pensions “disappeared”.

But no new investigation took place, leading Kumar to say: “I feel so angry on behalf of decent upright citizens robbed of their basic human rights. Somebody should be made responsible. There should be a public inquiry into this. People should be brought to account. These are greedy, selfish, capitalists who live on the backs of others”. (2)

These days Cohen is involved with Klaus Schwab’s World Economic Forum, whose website describes him as “a preeminent international philanthropist, venture capitalist, private equity investor, and social innovator, who is driving forward the global impact revolution”.

The WEF adds: “He is Chairman of the Global Steering Group for Impact Investment; Chairman of the Education Outcomes Fund for Africa and the Middle East; Chairman and co-Founder of The Portland Trust; co-Founder of Social Finance UK, US, and Israel; co-Founder of Bridges Fund Management UK, US, and Israel; and co-Founder of Big Society Capital.

“Each of the initiatives he leads today aims to shift the allocation of human and financial resources to creating positive impact”.

Cohen’s Big Society Capital is all about social impact investment, which it insists is “a trend that is set to continue”.

As its chairman, he enthused in 2014: “I believe there is, at the very least, an untapped $1 trillion of private sector impact investment”.

Cohen explains his interest in impact investment in much greater detail in a book published in 2020, entitled Impact: Reshaping Capitalism to Drive Real Change. (3)

Cohen explains his interest in impact investment in much greater detail in a book published in 2020, entitled Impact: Reshaping Capitalism to Drive Real Change. (3)

Here, he explains that we can thank him for having introduced venture capitalism to the UK, since during his continuing education at Harvard he “discovered venture capital just as it was emerging”.

Cohen adds that the arrangement for his studies in the USA required him to bring back something of value to the UK: “I ended up bringing back venture capital, for which I was knighted in 2001”. (4)

The businessman explains that he later switched his attention to impact investment, mainly through the Social Investment Task Force, which he set up in 2000 at the request of Tony Blair’s regime.

He recalls: “After David Cameron’s Conservative election win in 2010, he elevated responsibility for impact investment to the Cabinet Office which reports directly to the prime minister, where Frances Maude, Nick Hurd and Kieron Boyle led, among many other initiatives, the effort to establish Big Society Capital as a social investment bank that can drive the advance of the impact ecosystem”. (5)

In 2013, he says, Cameron “asked me to lead the G8 Social Impact Investment Taskforce, in order ‘to catalyze a global market in social impact investment’”. (6)

3. Financial services for the poor

Like his WEF colleague Klaus Schwab, and the business organisation’s phoney “youth movement” the Global Shapers, Cohen likes to depict “impact capitalism” (7) in the rosiest of lights.

As we will see later, the impact network’s presentation of its activity as indisputably worthy and in the general public good performs a crucial role in its overall strategy.

Thus Cohen coos that impact capitalism “will lead us to a new and better world” (8) by “helping those in need and preserving our planet”. (9)

It will address “a variety of social issues”, including homelessness, affordable housing, community organizations, childhood obesity and mental health, (10) not to mention “poverty, under-education, unemployment, an aging population and environmental destruction”. (11)

It will do this by “helping disadvantaged young people”, (12) supporting “refugee and immigrant integration” (13) and boosting “women’s empowerment and gender equality”. (14)

Impact projects aim to provide “financial services for the poor”, (15) “affordable and green housing” (16) and to “transform the lives of more than 12,000 households in rural Kenya and Uganda”. (17)

Cohen declares: “We must shift our economies to create positive outcomes”. (18) Make a mental note of that particular phrase…

Unfortunately for Cohen, the effect of all this “wokewashing” verbiage is severely undermined by his own account of the organisations and individuals who are on board his impact gravy train.

He tells us: “All big movements, including recent neoliberalism, were funded by philanthropists, and the same is becoming true of the impact movement. The Omidyar Network, Ford, Rockefeller, MacArthur, Kresge and Hewlett Foundation in the US; Europe’s Bertelsmann Stiftung in Germany and the Calouste Gulbenkian Foundation in Portugal; Lord (Jacob) Rothschild’s family foundation, Yad Hanadiv, and the Edmond de Rothschild Foundation, in Israel; and Ratan Tata and the Tata Trusts, in India, have all supported the impact movement”. (19)

He adds: “One of the most promising new family foundations is the Chan Zuckerberg Initiative (CZI). In 2015, at the age of 30, Mark Zuckerberg and his wife Priscilla Chan announced that they plan to direct 99 per cent of their $45 billion wealth into CZI. Their goal is to make a substantial commitment to impact investing that is focused on ‘personalized learning, curing disease, connecting people and building strong communities’”. (20)

Cohen approvingly quotes Megan Starr, the global head of impact for the arms-dealing Carlyle Group (closely linked to the WEF and its Global Shapers – see here and here), when she remarked that “it’s no longer possible to generate high rates of return unless you invest for impact”. (21)

He lists Goldman Sachs, “another big-name asset management firm that is involved in impact investing”, (22) “Unilever, under the enlightened leadership of CEO Paul Polman”, (23) The Bill and Melinda Gates Foundation, (24), Accenture, (25) Nestlé (26) and Coca-Cola. (27)

He lists Goldman Sachs, “another big-name asset management firm that is involved in impact investing”, (22) “Unilever, under the enlightened leadership of CEO Paul Polman”, (23) The Bill and Melinda Gates Foundation, (24), Accenture, (25) Nestlé (26) and Coca-Cola. (27)

Cohen tells us that Bono, of U2 and Band Aid fame, has, through his Rise Fund, “become a powerful advocate for the use of impact investment”. (28)

He mentions Emmanuel Macron (29) and Richard Branson’s B-Team, (30) while praising both Andela (31) in Nigeria (see here) and Ashoka, (32) that strange cult-like organisation so closely linked to Klaus Schwab’s Global Shapers as well as to the Transition Movement’s Rob Hopkins.

No self-respecting “philanthropist” billionaire today would be caught without his own personal foundation and Cohen explains why. “The nature of foundations makes them a perfect leader of the Impact Revolution. Because of their charitable status and sense of mission, they can experiment with different roles – acting as grantors, investors, guarantors or outcome payers. They can fund efforts to support the growth of the impact field, as well as influence delivery organizations, governments and investors to collaborate in new ways in tackling social problems”. (33)

And he does nothing to dispel suspicions of something rather alarming going on when he describes the activities of one particular foundation.

“Silicon Valley alumni Charly and Lisa Kleissner’s KL Felicitas Foundation is going all-in by dedicating its total assets of approximately $10 million to impact investing, and they are encouraging their peers to do the same. Under the umbrella of Toniic, a global action community of impact investors, the Kleissners co-founded the ‘100 per cent Impact Network’, a collaborative group of more than one hundred family offices, high-net worth individuals and foundations who have each pledged to dedicate their portfolios to impact investment. The group has a collective $6 billion of assets, with more than $3 billion already deployed, and aims to create an international movement of impact investors”. (34)

A fascinating aspect of the thinking behind Klaus Schwab’s Great Reset is his avowed fear of “political backlash”, “antiglobalization and “social unrest”.

The same anxiety seems to underlie Cohen’s mission to bring about what he repeatedly describes as the “Impact Revolution” (35) but which, in this light, would clearly better be termed the “Impact Counter-Revolution”, or the “Impact Coup”.

He writes, for instance, of his fear that a “curtain of fire” could soon separate the rich from the poor in our cities, as people revolt against injustice: “We have recently seen this curtain rise in countries such as France, Lebanon and Chile, which have suffered violent protests, while in the UK rising inequality was a factor in the decision taken in the referendum of June 2016 to leave the EU”. (36)

Cohen argues: “The fact is that our existing social contract has expired and we are now in the process of drawing up a new one in the form of impact capitalism”. (37)

In other words, his impact revolution aims to save capitalism by reshaping it. It is part of the Great Reset.

Cohen talks about “a historic transition”, (38) “resetting investment for a new reality”, (39) and dedicates a whole chapter to the thesis that “Impact investing sets the New Normal”. (40)

“Impact changes everything,” (41) he says. “Impact thinking will now transform our economies and reshape our world”. (42) “There has never been a more tangible opportunity to make a transformative difference”. (43)

Using the very same term as Schwab, the Global Shapers and the Guerrilla Foundation, Cohen believes in the importance of making “systemic change”, (44) and makes it quite clear in which direction this would take us.

Using the very same term as Schwab, the Global Shapers and the Guerrilla Foundation, Cohen believes in the importance of making “systemic change”, (44) and makes it quite clear in which direction this would take us.

He writes: “Impact entrepreneurs leading delivery organizations will be able to raise the funding they need to implement their innovative approaches at scale, bringing systemic change – just as venture capital and tech entrepreneurs brought systemic change through the Tech Revolution”. (45)

Indeed, Fourth Industrial Revolution technology inevitably forms part of Cohen’s vision, with talk of “drones and driverless cars”, (46) biotechnology, (47) and equipping schools in rural Africa with “an individualized e-learning platform, computer tablets and broadband access”. (48)

Like Schwab’s Great Reset, the Impact Revolution is apparently “an idea whose time has come”. (49)

Cohen announces, with all the thunderous authority of the Old Man of Davos: “It will take at least a decade to transform our system, and the transformation will unfold in stages: starting with impact investment and impact measurement; through the development of impact economies; to a new global system of impact capitalism”. (50)

So what precisely is impact capitalism and how, on a practical level, does it work?

It essentially amounts to a privatisation of the role of governments across a wide range of spheres, in which bringing about certain social outcomes is treated as a potentially profitable financial investment.

In Cohen’s words, describing an early scheme hatched up with New Labour’s Jack Straw: “If our effort helped the government save money, both investors and the organizations they funded could pocket a fraction of the money saved”. (51)

The word “impact” has been used in this context for the last 14 years. Recalls Cohen: “It was in 2007, at a meeting hosted by the Rockefeller Foundation at its Bellagio Center in Italy, that ‘impact investing’ was coined as a term to replace ‘social investment’”. (52)

Data is central to the way that impact schemes work, because investors need evidence of a positive outcome in order to justify the eventual profitable dividend. These are “pay-for-success investment models”, (53) explains Cohen.

He says: “If we regard impact investing as our rocket ship to social change, impact measurement is our navigation system. It will lead to change and the establishment of new norms”. (54)

The new norm for the large part of the world’s population is that their lives will be regarded as nothing but investment opportunities for the financial elite and their hopes, fears, successes and failures reduced to statistics on a centralised database.

Cohen speaks warmly of the Global Value Exchange, “a crowd-sourced database of over 30,000 impact measurement metrics that offers valuations in a similar way to the Unit Cost Database. For example, you can find out the annual cost of a homeless person who is out of work in the UK based on the benefits payments they receive, their lost income tax and national insurance payments, and their lost economic output”. (55)

Cohen explains more about the rules of this lucratively entertaining new game of gambling on the ups and downs of ordinary people’s lives across the world: “Social impact bonds involve three key players: outcome payers, social service providers (these are generally non-profit organizations, but they can also be purpose-driven businesses) and investors”. (56)

Children’s lives are of particular interest to the financial vampires of the impact scene, particularly those most ripe to be “improved” in a “pay-for-success” context.

Cohen writes about the work of the Education Outcomes Fund for Africa and the Middle East, which “aims to raise $1 billion to improve the education of ten million children”. (57)

He reveals it is “supported by an international group of foundations looking for innovative ways to maximize improvement in education in Africa and the Middle East, notably the Aliko Dangote Foundation, Ford, Omidyar, The Big Win, ELMA, UBS Optimus, Hewlett and DFID”.

It will “help catalyze investment in effective education delivery organizations, such as Camfed, an NGO that has supported the education of over 500,000 girls in the most deprived communities of Zimbabwe, Tanzania, Ghana, Zambia and Malawi”. (58)

It will “help catalyze investment in effective education delivery organizations, such as Camfed, an NGO that has supported the education of over 500,000 girls in the most deprived communities of Zimbabwe, Tanzania, Ghana, Zambia and Malawi”. (58)

Cohen wants to “integrate impact investment into international development aid” to create a new kind of impact imperialism closely tied in to the UN’s Sustainable Development Goals, which “will require $3.3–$4.5 trillion each year over the next decade”. (59)

He is pleased to report that the UK’s Department for International Development in the UK “launched its Impact Programme in 2012 and planned to provide up to £160 million ($212.8 million) over 23 years, in order to catalyze the market for impact investment in sub-Saharan Africa and South Asia”. (60)

For impact capitalism, everything is a potential source of investment and, thus, profit – from nature to education, from the oceans to gender.

Cohen says: “Bringing impact measurement to the bond market, which as we have previously seen totals $100 trillion, will also have a major effect. The place to start here is with green bonds (climate), which are now being followed by blue (oceans), education, social and gender bonds.

“For example, Prince Charles, founder of the British Asian Trust, and Richard Hawkes, its CEO, have announced the launch of a $100 million gender bond to provide access to better education, jobs and entrepreneurial opportunities for half a million women and girls in South Asia.

“The market for green bonds stands at around $750 billion today; if they and other purpose-driven bonds that measure their impact come to account for 10 per cent of the $100 trillion bond market over the next ten years, this would bring $10 trillion of funding to companies for projects that contribute to the SDGs”. (61)

For Cohen, this “new model for philanthropy and aid” (62) is the start of something big and he says it is “time to scale Outcome Funds”. (63)

These are “professionally managed vehicles that sign outcome-based contracts with social delivery organizations” and their goal is to “drastically reduce the time and cost it takes to put them in place”. (64)

“We must shift our economies to create positive outcomes”, (65) he declares. We told you to bear that phrase in mind. All is becoming clear!

Impact investing is all about problems and solutions.

“As the natural torchbearer of the impact movement, philanthropy has the power to usher in a new dawn for charitable organizations, investors, entrepreneurs, businesses and governments, to bring solutions to the greatest social and environmental problems of our time”, (66) writes Cohen, glossing over the fact that impact capitalists are not so much bringing solutions as selling them.

In order for Cohen and his friends to be able to sell a “solution”, the “problem” which this supposedly addresses needs to be officially recognised as such.

It is here that the UN’s Sustainable Development Goals play a key role.

They define specific areas in which governments should be taking action and require them to find money to pour into these issues.

Cohen is, in fact, a member of the UNDP’s Global Steering Group for Impact Investment.

SDG Impact, as it calls itself, “is a UNDP initiative tasked with developing resources under three central pillars to accelerate investment towards achieving the United Nations Sustainable Development Goals by 2030”.

It boasts that its “transformational impact” will involve “opening up $12 trillion in market opportunities”.

Cohen notes, with appreciation, in his book, that “in 2015, the impact investing movement gained focus and urgency with the release of the United Nations Sustainable Development Goals”. (67)

But he adds: “It has been estimated that financing the achievement of the SDGs will require an additional $30 trillion in investment over the next decade”. (68)

Where is a typical cash-strapped government going to get that all money from, apart from by increasing an already-crippling national debt to the global bankers?

Where is a typical cash-strapped government going to get that all money from, apart from by increasing an already-crippling national debt to the global bankers?

Cohen suggests that states “release unclaimed assets to establish ‘impact capital wholesalers’”.

He explains: “Imagine that you could snap your fingers and create an extra $2.5 billion in a country’s budget, without either raising taxes or cutting crucial programs. Governments around the world are starting to discover that they can do this by using unclaimed assets, essentially creating money out of thin air”. (69)

He adds that in this way a government “can access money that is public money but not tax money, such as unclaimed assets in banks, insurance companies and investment funds. This money can be used to develop a strong sector of impact investment managers who provide start-up and growth capital to charitable organizations and purpose-driven businesses”. (70)

So he thinks the money created “out of thin air” by these “unclaimed assets” should be diverted, by the state, directly into the impact investment slush funds with which he is involved, so that they can be essentially lent back to the state in the form of pay-for-success social investments, to the eventual profit of impact capitalists?

There certainly seem to be significant sums involved. Cohen writes: “In 2019, the Dormant Assets Commission chaired by Nick O’Donohoe reported that up to an additional £2 billion ($2.7 billion) could be released from unclaimed assets held by insurance companies, pension funds and investment funds”. (71)

It is no coincidence that Cohen himself was chairman of a similar initiative, the UK’s Commission on Unclaimed Assets, from 2005-2007. (72)

He reveals: “The UK was the first country that saw the potential of unclaimed assets to spark real change in society. In 2011, following the recommendation of the Commission on Unclaimed Assets (2005–7), which I chaired, Francis Maude, who was then leading the Cabinet Office, asked me and Nick O’Donohoe from JP Morgan to establish a social investment bank along the lines recommended by the Social Investment Task Force in 2000.

“The Cameron government, he informed me, was prepared to provide £400 million ($532 million) of unclaimed bank assets for this purpose. In 2012, this money, having been supplemented by an additional £200 million ($266 million) from Barclays, HSBC, Lloyds and the Royal Bank of Scotland, went to establish Big Society Capital (BSC), with me as Chair and Nick O’Donohoe as CEO.

“Since then, an additional £600 million ($798 million) has been released to the Reclaim Fund, which collects the flow of unclaimed assets and distributes them according to the instruction of the government”. (73)

It interesting to note that fellow impact investor Antonis Schwarz of Guerrilla Foundation, funders of social justice “activists”, has spoken about his “campaign to unlock dormant assets for social impact investing in Germany”.

Impact capitalists also have their eyes on pension funds, as former employees of British United Shoe Machinery may not be surprised to hear.

Cohen writes: “The world’s pension funds held $38 trillion in 2016, nearly 20 per cent of the world’s total investment assets. If our pension fund managers were to optimize risk–return–impact, they could significantly support the achievement of the SDGs”. (74)

“Pension fund regulations are a priority for governments, given that pension funds hold so much money globally. It is reasonable for pension savers to be given the option, as happens in France, to choose savings programs that will invest in line with their values – for example, portfolios that aim to contribute to the achievement of the UN’s Sustainable Development Goals”. (75)

It is clear from all this that the impact capitalists have taken a big step away from the classic liberal free market mentality which regards the state as purely an impediment to entrepreneurial activity.

Instead, the state plays a crucial role in their plans. The merger of public and private which they seek is not the state-communist idea of government taking over business, but rather the fascist model of business taking over government (see here, here and here).

Cohen, in his book, specifically states that the “new system” of impact capitalism “aligns the private sector with government” (76) and makes it quite clear that impact investment could not work without the active involvement of the state.

After all, the whole idea is that the debt-crippled nation-state cannot afford to provide the “solutions” demanded by the UN’s Sustainable Development Goals, and is therefore obliged to seek pay-for-success investments in these areas from impact capitalists.

Cohen makes no effort to hide what impact capitalists want from governments.

“Governments can accelerate the transition to risk–return–impact economies. They are best positioned to catalyze rapid growth in impact investment, just as they did for venture capital in the late 1970s”, (77) he writes.

“The role of governments in creating systemic change is crucial. Mariana Mazzucato rightly argues in The Entrepreneurial State that governments have actively shaped and created markets. This is what governments need to do for the impact market today. They can stimulate its growth in very clear ways”. (78)

“The role of governments in creating systemic change is crucial. Mariana Mazzucato rightly argues in The Entrepreneurial State that governments have actively shaped and created markets. This is what governments need to do for the impact market today. They can stimulate its growth in very clear ways”. (78)

“Governments can provide financial support for incubators and accelerators that nurture purpose-driven enterprises, help prepare them for impact investment and mentor them so that they are capable of delivering impact at scale”. (79)

“Philanthropy can only do so much to help governments meet these challenges: philanthropic foundation donations stand at $150 billion each year globally, a small figure relative to government expenditure”. (80)

“I hope the new thinking revealed in these pages will lead our governments to direct their massive economic measures in such a way that it creates the maximum positive social impact”. (81)

“As the risk–return–impact model disrupts prevailing business thinking, and governments introduce new incentives to drive impact entrepreneurship, impact entrepreneurs will revolutionize our approaches”. (82)

“Shifting the mindset of government procurement from pre-scribing services in detail to paying for outcomes achieved through SIBs will drive the use of pay-for-outcomes approaches, and create a thriving outcomes market for the first time”. (83)

“It is time for governments to lead us on the new path of impact investment, towards impact economies and impact capitalism”. (84)

“Governments must play a role in facilitating and nurturing the impact market, by developing standards in measurement and reporting, building market infrastructure and introducing incentives for investors”. (85)

Yep, we’ve got the picture, Ronnie.

Of course, the fly in the governmental ointment for the entrepreneurial class is that states do insist on regulating and limiting money-making activities in order to curry favour with The Voters, those poor saps who imagine that the politicians they elect are there to represent their interests and not those of the Global Business Community.

However, as Schwab noted with some satisfaction in his own 2020 book, the Covid crisis means that those inconveniently democratic days are now behind us and we can march forward to a glorious New Normal of totally unchecked profit and exploitation.

“There has never been a better time to launch an impact business, in part because the legal and regulatory environment is becoming much friendlier,” (86) declares Cohen.

He looks back nostalgically to the last major round of financial regulation that allowed him to amass his own personal fortune at the expense of the rest of us: “The explosion in venture capital in the 1980s offers an example of how an industry can be radically transformed through regulatory changes and tax incentives”. (87)

“After 1979, pension fund commitments to venture capital rose dramatically as a result, from $100–200 million a year during the 1970s, to more than $4 billion each year by the end of the 1980s. This important change in regulation combined with the reduction of capital gains tax to 28 per cent in 1978 and to 20 per cent in 1981 gave a big boost to venture capital, which has since grown to become about a trillion-dollar global pool”. (88)

“The experience of my own firm, Apax Partners, shows what is possible when a change in regulations opens up a market. Our first fund in Europe, which was raised in 1981 to invest in the UK, amounted to just £10 million ($13.3 million). Our last European fund before I left the firm, raised in 2002, amounted to €5 billion ($5.6 billion), and Apax has since raised an €11 billion fund ($12.2 billion)”. (89)

“The experience of my own firm, Apax Partners, shows what is possible when a change in regulations opens up a market. Our first fund in Europe, which was raised in 1981 to invest in the UK, amounted to just £10 million ($13.3 million). Our last European fund before I left the firm, raised in 2002, amounted to €5 billion ($5.6 billion), and Apax has since raised an €11 billion fund ($12.2 billion)”. (89)

Cohen and his fellow impact capitalists have been doing all they can to anticipate and avoid any government regulation or taxation that might hinder their activities.

By aligning their investment strategy with the UN Sustainable Development Goals – or should that be the other way round? – they ensure that their schemes are officially classified as “doing good” and thus “we avoid the risks that accompany investments that do harm: the risk of future regulation, taxation and even the prohibition of activities that could put a halt to business altogether”. (90)

But he would still like to see positive state help in this respect: “Government must adapt to the new thinking about risk–return–impact, and use its regulatory power to accelerate its advance”, (91) he insists. It should “boost the supply of impact capital through changes in regulation and tax incentives”. (92)

“We saw earlier that changes in regulation can be a huge boost in the financial arena. We must widely replicate the initial breakthrough in the US, where a change in regulation opens the door for trustees of foundations and pension funds to make impact investments”. (93)

The bottom line behind all this talk of “social impact”, as will be blindingly obvious by now, is good old-fashioned profit.

Cohen is, in fact, quite eager to point out the lucrative potential of the project, perhaps anxious that some might be fooled by all the talk of “helping those in need and preserving our planet” into imagining that he has gone soft in his old age and is no longer the hard-headed business tycoon we all know and love.

He recalls: “For me, the breakthrough in impact thinking came in September 2010, when for the first time we linked the measurement of social impact to financial return”. (94)

“We wanted to make an impact through investment, so we thought like investors and set out to find a way to deliver measurable impact, alongside a 10–12 per cent annual financial return. Eighteen years on, Bridges has raised over a billion pounds and delivered an average net annual return of 17 per cent”. (95)

“The Peterborough SIB achieved a 9.7 per cent reduction in the number of convictions, and paid investors 3.1 per cent a year on top of their capital”. (96)

“Being able to supply underserved populations with products and services allows businesses to tap into huge demand, which in turn creates the opportunity to grow more quickly than companies that serve mainstream markets at higher prices”. (97)

“Being able to supply underserved populations with products and services allows businesses to tap into huge demand, which in turn creates the opportunity to grow more quickly than companies that serve mainstream markets at higher prices”. (97)

“When entrepreneurs aim for profit and impact at the same time, they are able to define ways to succeed without sacrificing financial returns and are often turning their impact into a key driver of their success. Because they place impact at the core of their companies’ business models, their profits grow together with their impact”. (98)

Cohen is very proud of the fact that the world’s first Development Impact Bond in India, put together by Instiglio, the Colombia-founded impact finance advisor, was “a success”.

He relates: “UBS Optimus Fund recouped its initial funding of $270,000 from the outcome payer, the Children’s Investment Fund Foundation, plus $144,085 representing a 15 per cent annual return”. (99)

He relates: “UBS Optimus Fund recouped its initial funding of $270,000 from the outcome payer, the Children’s Investment Fund Foundation, plus $144,085 representing a 15 per cent annual return”. (99)

“Starting an impact venture is a reliable way to be more successful”, (100) Cohen stresses. “Investors will come to realize that we are able to increase returns not in spite of impact, but because of it”. (101)

“When we view the world through an impact lens, we discover opportunities to achieve higher growth and returns that we would otherwise pass by”, (102) he explains. “Impact thinking uncovers opportunities that we would otherwise miss”. (103)

“Investment returns from risk–return–impact will be at least as good as the returns from risk–return, and most likely better”. (104) “Impact helps deliver higher rates of return”. (105)

One possible pitfall awaiting the impact capitalist model regards the supply of raw materials from which they can extract these significant financial returns.

These raw materials are the “problems” for which the investors sell the “solutions”. As Cohen puts it himself: “Impact entrepreneurs thrive wherever there are major social and environmental issues to tackle”. (106)

One way to ensure that there are enough problems from which to profit is to define a certain state of affairs as “a problem”, have that definition officially recognised and then get paid by the public purse for “solving” it.

If, for instance, the fact that large parts of the population of Africa or India live close to nature and are not connected to the internet is defined as a “problem”, then the “solution” of technological “inclusivity”, pushing them into the digital world, is going to pay out for impact investors.

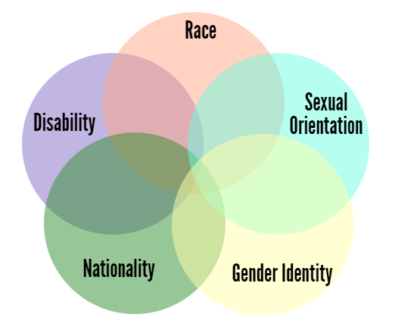

In the “woke” world to which these capitalists are so strangely close, there will always be another oppressed minority waiting to be discovered and championed. On a pay-for-success basis.

In the “woke” world to which these capitalists are so strangely close, there will always be another oppressed minority waiting to be discovered and championed. On a pay-for-success basis.

The other way that impact capitalists can rely on there being enough problems for which they can offer “solutions”, is to ensure that, while they might be able to statistically prove “positive outcomes” in very narrow and specific areas, the poor underlying conditions remain intact.

They are, of course, doing just that by treating the wide-ranging damage caused by capitalists as just another money-making opportunity for those very same capitalists to exploit.

By getting richer and richer from their investments, the impact investors actively make sure that social injustice remains a problem for which they can keep selling so-called “solutions”.

By promoting the Fourth Industrial Revolution and all the mining, manufacturing, power consumption and waste that comes with it, they are making it inevitable that the environmental destruction they claim to be solving with their snake-oil fake-green technologies will not just continue but will massively increase.

This means that they can keep making money by selling yet more “solutions” to the problems they are helping to perpetuate!

In addition, as Alison McDowell points out, economic parasites can also make money by gambling with these impact deals on the financial markets, so that even failure can turn out to be profitable for some.

In addition, as Alison McDowell points out, economic parasites can also make money by gambling with these impact deals on the financial markets, so that even failure can turn out to be profitable for some.

She writes: “Bundling the debt that SIBs represent transforms them into liquid securities that are immediately available for high frequency trading.

“The level of risk associated with these derivatives fluctuates as data flows through digital platforms linked to public service delivery.

“As bets and counter-bets are made by elite financial investors, the future prospects of real people are woven into the oppressive operations of global financial markets”.

While Cohen may see all this as “a win-win-win situation”, (107) it represents nothing short of disaster for humanity and our Mother Earth.

Like some demented monster feeding furiously off its own excrement, the impact capitalist empire will keep expanding, bloated with its own endlessly recycled toxicity, until its insane and insatiable greed has destroyed us all.

Unless we can stop it.

1. https://en.wikipedia.org/wiki/Ronald_Mourad_Cohen

2. Kumar, described as “fearless in pursuit of what he saw as right”, was found dead in his home in Middlesborough just before the 2010 general election. The Indian-born 53-year-old was not believed to have been unwell but his death was quickly declared by police to be of natural causes.

3. Ronald Cohen, Impact: Reshaping Capitalism to Drive Real Change (London: Ebury Press, 2020). All subsequent notes are ebook position references (%) to this work.

4. 3%

5. 65%

6. 4%

7. 78%

8. 2%

9. 78%

10. 69%

11. 63%

12. 67%

13. 67%

14. 59%

15. 59%

16. 59%

17. 68%

18. 63%

19. 63%

20. 62%

21. 33%

22. 33%

23. 37%

24. 61%

25. 37%

26. 37%

27. 37%

28. 33%

29. 36%

30. 37%

31. 20%

32. 25%

33. 62-63%

34. 60%

35. 74%

36. 2%

37. 78%

38. 72%

39. 35%

40. 26%

41. 63%

42. 5%

43. 6%

44. 57%

45. 57%

46. 17%

47. 19%

48. 56%

49. 78%

50. 78%

51. 10%

52. 6%

53. 53%

54. 13%

55. 13-14%

56. 10%

57. 56%

58. 56%

59. 67%

60. 68%

61. 77%

62. 53%

63. 55%

64. 55%

65. 63%

66. 63%

67. 28%

68. 29%

69. 68%

70. 64%

71. 70%

72. 1%

73. 69%

74. 31%

75. 71%

76. 4%

77. 64%

78. 65%

79. 71%

80. 3%

81. 2%

82. 26%

83. 64%

84. 73%

85. 72%

86. 24%

87. 70%

88. 64%

89. 71%

90. 27%

91. 72%

92. 70%

93. 76%

94. 5%

95. 9%

96. 11%

97. 16%

98. 25%

99. 54%

100. 16%

101. 27%

102. 28%

103. 18%

104. 74%

105. 78%

106. 26%

107. 10%

MORE READING:

Klaus Schwab and his great fascist reset

Shapers of slavery: the leadership

Shapers of slavery: the empire

Shapers of slavery: the awakening

6. Privatising government

6. Privatising government

Really disturbing how parasites like Cohen are going after “unclaimed assets”, as if they are his personally.

I have no idea how to fight this kind of emerging technocratic feudalism, a dark age type of fascism. I think we have to keep to our principles no matter what and try to live a life as connected to nature as we can.

LikeLike

Many thanks for posting this. I had not been aware of the significance of Sir Ronald Cohen to the Great Reset.

In spite of the “controversies” around Cohen’s pillaging of pension funds from 2000, Tony Blair saw fit to bestow his knighthood in 2006. Cohen’s donations to New Labour trumped everything.

In 1987 Cohen married his third wife, Sharon Harel, daughter of Yossi Harel (1918– 2008). Harel is rightly famous for being the commander of the Holocaust survivors’ ship Exodus. But from the 1950s he was “a leading member of the Israeli intelligence community”. Moshe Dayan recruited him as head of Unit 131, a top secret intelligence unit within the IDF – distinct from Mossad, the national intelligence agency.

https://en.wikipedia.org/wiki/Yossi_Harel#Military_and_intelligence_career

https://web.archive.org/web/20080601224018/http://www.haaretz.com:80/hasen/spages/978096.html

https://en.wikipedia.org/wiki/Lavon_Affair

LikeLike

Thank you for this post. I share it to my blog

LikeLike

That was a lot to digest. (And, clearly, a lot work. Thanks!) For a guy who never finished high school and lacks specialized knowledge and math skills, I will only be to take in so much here. But I certainly get the gist of things. Those playing God will go to extreme lengths to avoid doing honest work. The only honest work that interests them will come from slaves, once that project – the global biosecurity police State – is finished.

Clever, clever, clever schemers, with lots of money and, therefore, power, will – right now ‘are’ – going up against cleverness that they can’t even comprehend. The outcome is certain and they will not profit from it.

LikeLike